Seniors enrolling in private Medicare policies starting this week are finding fewer options, as health insurers close down certain types of plans due to legislative changes and looming cuts to federal funding.

Cigna Corp., Harvard Pilgrim Health Care, several Blue Cross Blue Shield plans and others aren't renewing hundreds of Medicare Advantage plans, which are Medicare policies administered by private insurers. The moves will displace some 700,000 beneficiaries who must find new policies, according to Humana Inc., a large seller of Advantage plans.

For 2011, the Kaiser Family Foundation said there will be a 13% decline in the number of Medicare Advantage plans.

The pullback is largely due to a 2008 law that required the plans to have networks of preferred doctors, with the idea that managed care could be less costly and aggressive marketing could be curbed. Some providers of traditional fee-for-service policies decided to close the plans rather than invest in networks. But some insurers say the federal health-care overhaul, which includes $140 billion in cuts to reimbursements for Advantage plans over 10 years, is a factor as well.

In the near term at least, consumers in remaining plans will see relatively flat premiums and richer benefits, the result of provisions in the health overhaul to pay for preventive care services and cover more drugs.

But over the longer term, insurance executives predict a continued tightening in the market.

"It is hard to imagine these cuts to Medicare Advantage and nothing is going to change," said Michael McCallister, chief executive of Humana. The firm closed or merged 31 fee-for-service plans for next year, but sees growth in its remaining business as it picks up seniors displaced when competing plans close.

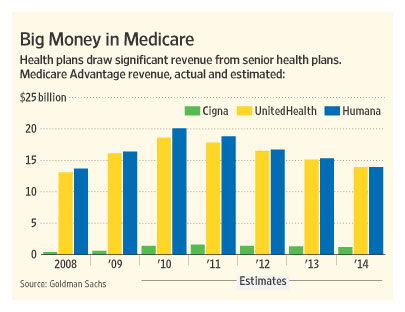

Medicare Advantage is expected to bring in more than $51 billion in revenue for major health plans this year, according to a Goldman Sachs estimate. That revenue could drop to as low as $37 billion in the next few years as the cuts kick in, Goldman estimates, but insurers likely will find new ways to bring in business, and sales are expected to climb back to $51 billion by 2018.

Humana, where the program accounts for more than half of the company's sales, says that its continued growth depends on reducing costs 15% below traditional Medicare's payment rates.

Due in part to Medicare funding cuts, Humana on Thursday projected a decline in earnings for next year to $5.35 to $5.55 per share, compared to this year's target of $6.40 to $6.50.

Nonetheless, Humana expects to make a 5% profit margin going forward on the business, hopes to expand its membership next year, and reiterated its confidence in Medicare Advantage over the long term.

About a quarter of seniors get their coverage through Medicare Advantage plans, which are popular because they tend to have affordable premiums and provide extra benefits such as gym memberships. The plans tend to yield high profit margins, typically 5% or more, for insurers, consultants say, because the government pays them more than it does traditional Medicare, an arrangement originally devised in the early part of this decade to lure insurers and seniors into the private market.

Sentara Healthcare's Optima Health, an insurer in Virginia Beach, Va., has decided to shutter two plans for next year because of pending health-overhaul cuts. A spokeswoman said the cuts will make it impossible to shoulder the higher administrative and medical costs in those plans.

Harvard Pilgrim said the decision to close its plan was largely based on the new network requirements, but that it also considered the future viability of Medicare Advantage. "The likelihood that there would be cuts at some point played a role," said spokeswoman Sharon Torgerson.

CMS said it can't comment on business decisions of individual carriers and is closely tracking seniors whose plans have been eliminated, to make sure they understand their options.

"Virtually all members continue to have access to a Medicare Advantage plan," said Donald Berwick, CMS's administrator. "The Medicare Advantage program is stronger than ever before, and more affordable."

For 2011, the government denied rate increases to many plans, and premiums on average will drop by 1%, CMS said. Humana, for instance, said its member premiums will drop by 10 cents next year, compared with a $7.81 increase in 2010.

Meanwhile, the overhaul means new benefits for seniors. For instance, coverage for prescription drugs is expanded. New preventive-care rules mean seniors will also be able to get procedures such as colonoscopies and mammograms for free.

Paula Iverson, 59, of Capitola, Calif., is examining options for her husband, who will turn 65 next year. She wants an Advantage plan instead of government-run Medicare, since she believes Advantage plans are affordable and the benefits more robust. "I don't want to worry about out-of-pocket expenses," she said.

She says she fears further cuts but hopes that the prospects of baby boomers aging into the system will prevent plans from reducing coverage.

Insurers with remaining plans are stepping up marketing to court displaced seniors, said John Gorman, chief executive of Gorman Health Group, a Washington, D.C., consulting firm specializing in Medicare. "In part, benefits are good because insurers have to compete for these folks," he said.

This year, open enrollment ends Dec. 31, whereas in the past seniors have had into the spring. As a result HealthNet, for instance, is doubling its sales force to sell its remaining plans that have networks.

HealthNet stopped selling its private fee-for-service plans this year. "We are not seeing the doom and gloom that has been predicted," said Arthur Kummer, HealthNet's vice president of Medicare programs. "But it will be here."Humana's Mr. McCallister said his company has kept most plans robust this year despite a government freeze that kept reimbursements at last year's levels. He added new benefits in some markets, including a website with offers for adults who are providing unpaid care to a loved one.

The year after next will be a different story, though: "The squeeze is upon us and more significant changes will start happening in 2012," he said.

No comments:

Post a Comment